- Blake Moret, Chairman and CEO

January

February

March

April

May

June

July

August

September

October

November

December

Rockwell Automation, Inc. (NYSE: ROK)

NYSE: ROK

As the world’s largest pure-play industrial automation and digital transformation company, we create outcomes that help our customers – industrial companies in more than 100 countries – to be more resilient, agile, and sustainable.”

Latest Events & News

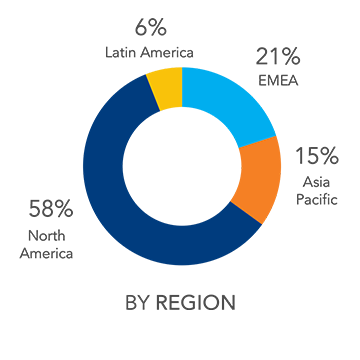

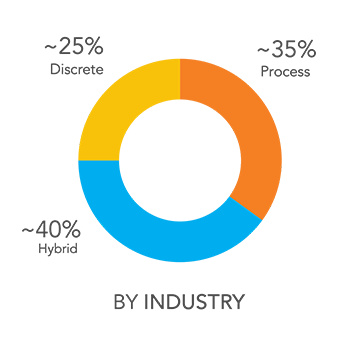

Rockwell At-a-Glance

Q1 Fiscal 2024 Highlights

Click the tiles to access quarterly highlights. View more financials here.

Celebrating 20+ Years on the NYSE